According to the company’s most recent Form 13F filing with the SEC, Magnetar Financial LLC purchased a new interest in Intel Corporation (NASDAQ: INTC) during the fourth quarter. For almost $2.06 million, the institutional investor bought 102,614 shares of the chipmaker’s stock.

An increase in institutional investors Intel Corporation

Magnetar Financial’s increased exposure to Intel was not unique. In Q4, a number of additional hedge funds and institutional investors increased their holdings:

- Finley Financial LLC: Invested $25,000 in a new stock.

- Synergy Investment Management LLC: $27,000 worth of shares were bought.

- Department of BankPlus Trust: $28,000 worth of Intel shares was added.

- Keystone Financial Group Inc.: Purchased $29,000 worth of shares.

- In the third quarter, Quest Partners LLC increased its holdings by 7,370.6%, and as of right now, it owns 1,270 shares worth $30,000.

- The fact that 64.53% of Intel’s outstanding shares are currently held by institutional investors and hedge funds shows that interest has remained strong despite the company’s financial difficulties.

Intel’s Financial Results and Prospects

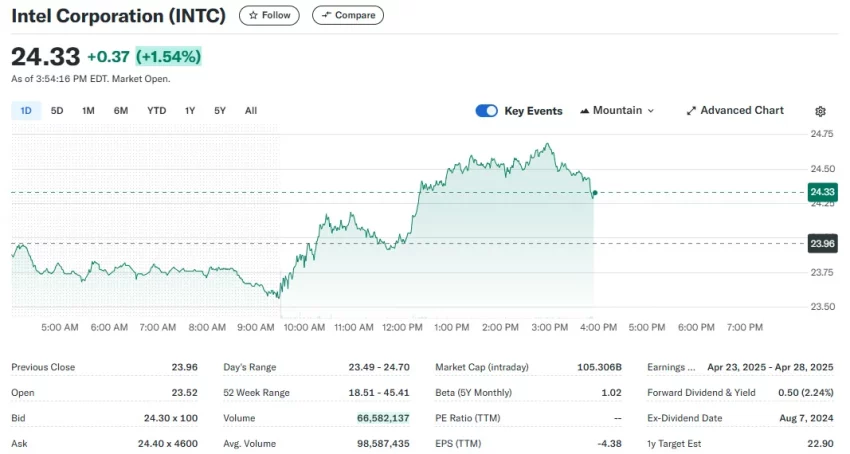

Friday’s opening price of $23.96 for Intel shares put it close to its 52-week low of $18.51 but far from its 52-week high of $45.41. The business’s financial indicators show persistent difficulties:

- Cap of the Market: $103.75 billion.

- With a PE Ratio of -5.47, earnings are negative.

- A beta of 1.02 indicates a modest level of volatility.

- A stable liquidity position is indicated by the current ratio of 1.33.

- With a debt-to-equity ratio of 0.44, the leverage is acceptable.

- The poor ($0.02) EPS from Intel’s Q4 2024 earnings, which were released on January 30, fell short of analysts’ $0.12 to $0.14 projections. The business reported a negative return on equity of 3.27% and a negative net margin of 35.32%.

Wall Street’s Wary Attitude Analysts’ opinions on Intel’s prospects are still split:

- Benchmark: A “Hold” rating was reiterated.

- UBS Group: Retained its “Neutral” rating while lowering its price objective from $26.00 to $23.00.

- Rosenblatt Securities: Maintained a $20.00 target price and a “Sell” rating.

- Mizuho: Maintaining a “Neutral” position, it lowered its goal from $23.00 to $21.00.

- Cantor Fitzgerald: rated the stock as “Neutral” and increased its price objective from $22.00 to $29.00.

- Intel presently has a consensus recommendation of “Hold,” with a target price of $27.04, according to MarketBeat.com.

What Will Intel Do Next?

Intel’s recent leadership changes and ongoing production expansions may present long-term growth prospects, albeit the conflicting analyst prognosis. Its short-term success is challenged, meanwhile, by factors including diminishing margins and heightened rivalry from rivals like AMD and Nvidia.